Interest from investors on the rise as the number of short-let rentals rises.

Short-let apartments are in high demand in Nigerian cities due to increased travel and tourism costs as well as travelers’ preference for affordable lodging.

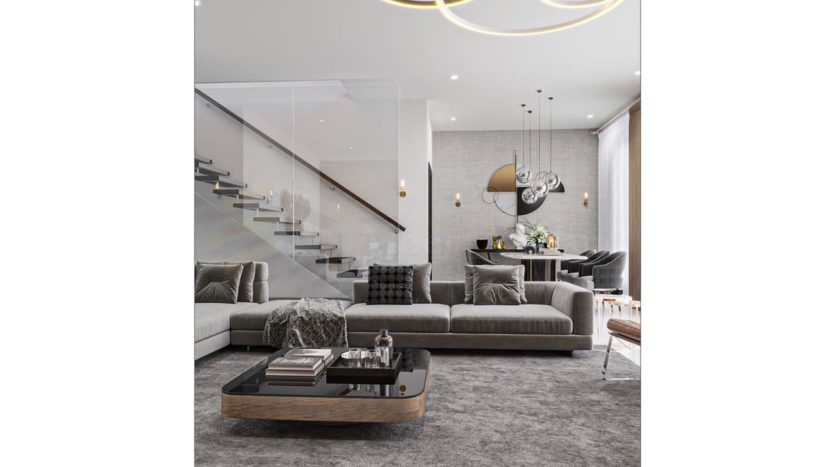

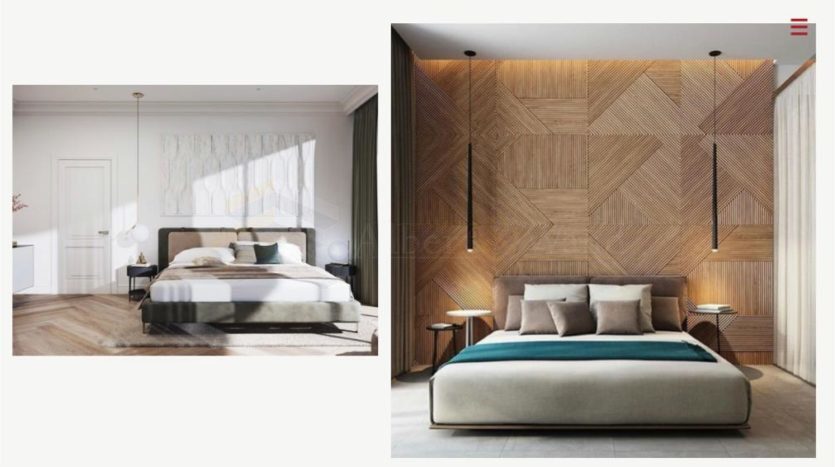

Short-let apartments are homes that are thought of as alternatives to hotels. Depending on demand, short-let apartments may be rented out for a few weeks, a few months, or even a year. These options could include bungalows, duplexes, bedrooms, and studio units.

As everyday demand rises relative to the residential and hospitality industries, the services have continued to experience an estimated 200 percent growth, according to an investigation by The Guardian.

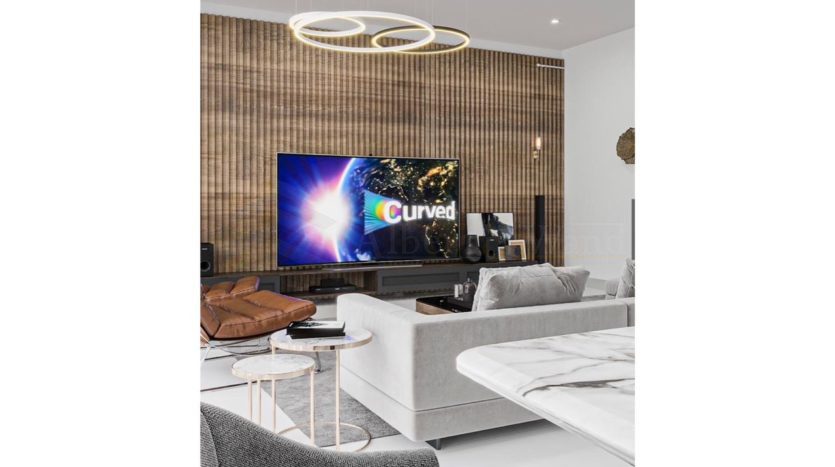

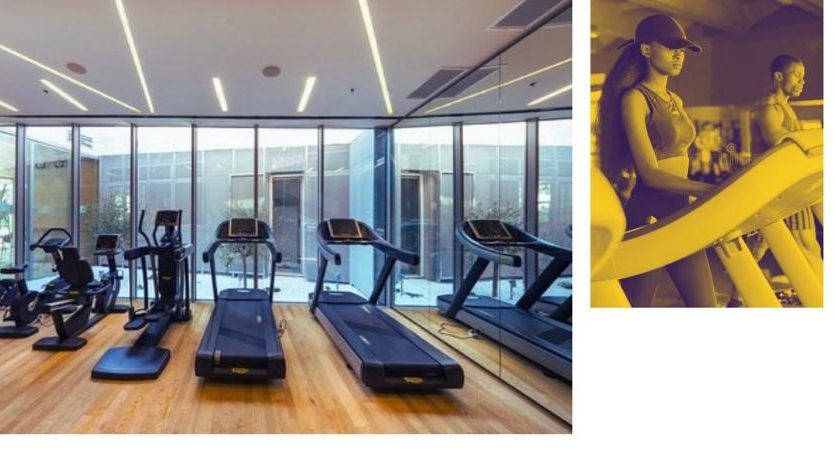

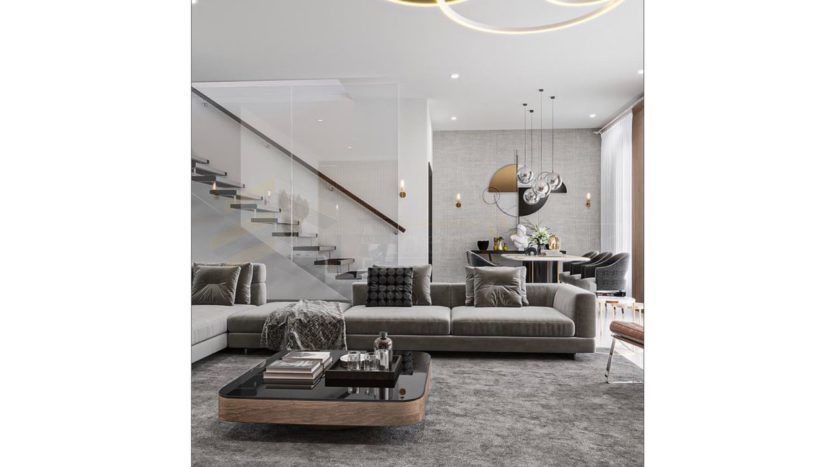

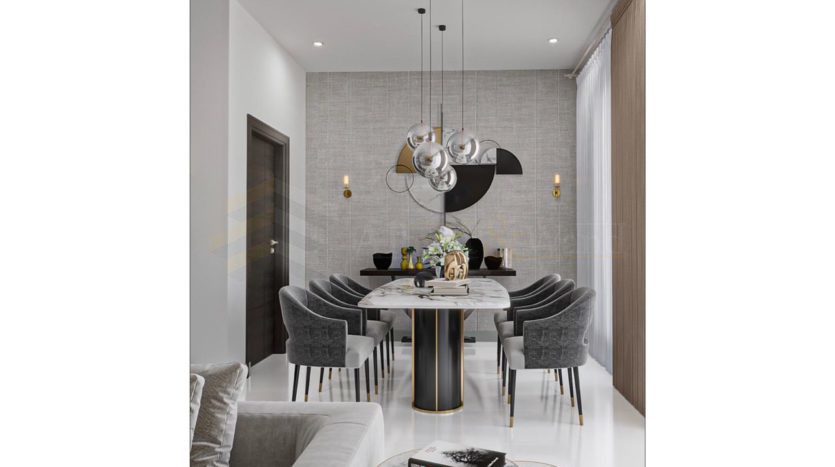

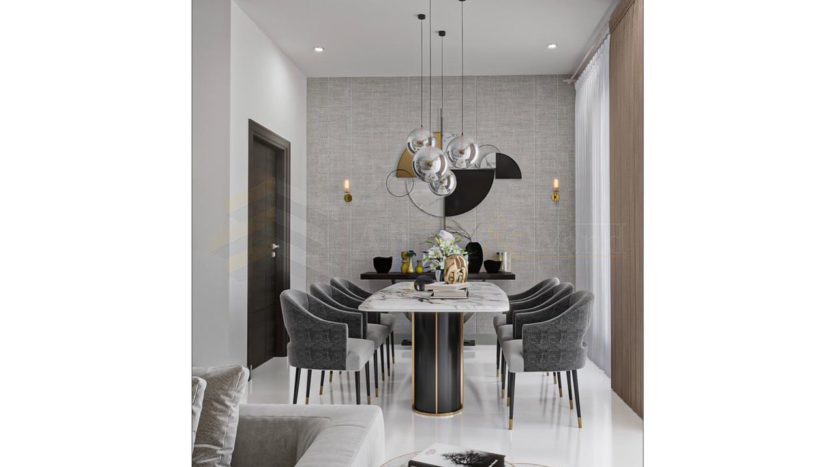

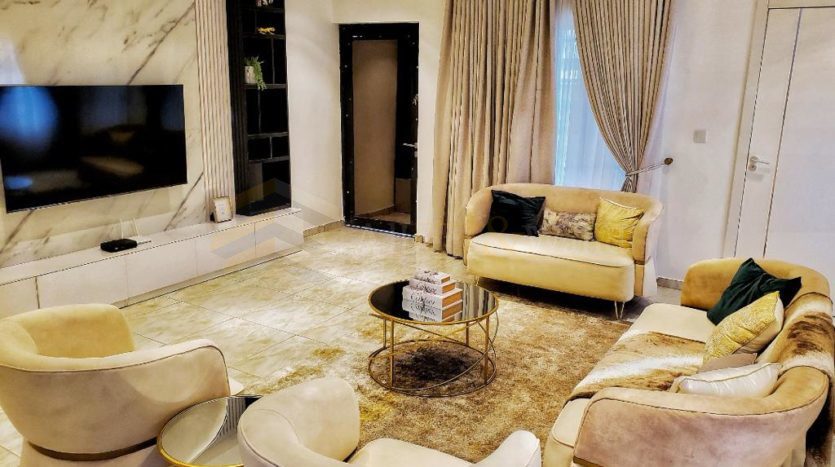

The sector’s appeal is based on the comfort, beauty, and provision of opulent amenities. Apartments often provide a kitchen, internet connection, 24-hour light and water, air conditioning, security, full furnishing, access to Digital Satellite Television (DSTV), closed-circuit television for security, parking spots, washers, and dryers in order to accommodate customers’ needs.

As of 2021, the global short-let rental market was valued at $99.38 billion, and it is anticipated to grow at a compound annual growth rate (CAGR) of 11.1% through 2030. The rise in popularity of short-let apartments is due to their favorable income profiles and accessibility to investors, operators, and tenants.

Short-let apartments in Nigeria took advantage of the Covid-19 lockdown, a time when most hotels were out of business and had to shut their doors to guests, to make significant strides.

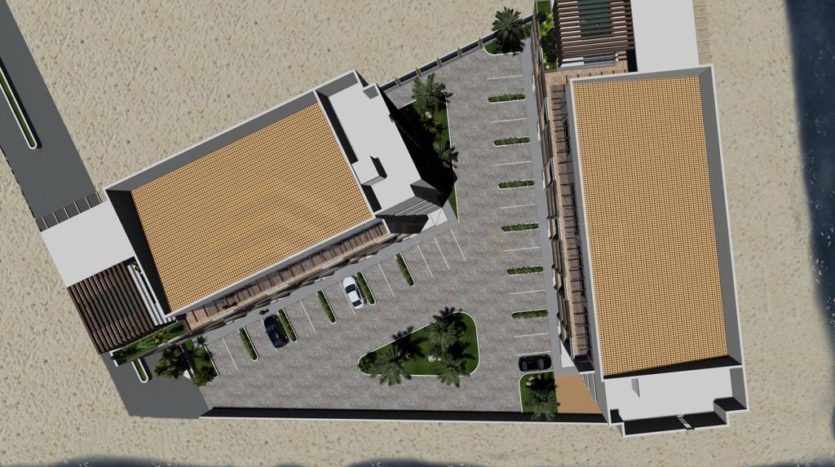

In Abuja, Port Harcourt, Ibadan, Lagos, and other places, short-let residences are being developed at a growing rate. There are more than 2,000 short-let projects, specifically, in Lagos, supported by different developers.

Lagos’ short-let market has expanded by 263% over the last three years, according to Pan-African real estate analytics provider EstateIntel. The Guardian got a paper titled “Boom or Bust? According to Lagos Short-let Market, the growth was mostly fueled by an increase in the demand for long- and short-term lodging in apartments.

Additional explanations for its success include the fact that short-let offers an alternative to “traditional” tenants, investors’ strong income profiles, younger demographic patronage as short-let is becoming a less expensive lodging option, and the “diaspora” effect.

The dominant position of the short-let market is a deeply ingrained tendency in the Lagos housing industry. As the market is not used to monthly rentals, the introduction of this sector is essentially a backward correction of the market. Low entry barriers made it possible for people to equip and deliver flats to the general public on a daily and monthly basis, which satisfied a demand that had been unmet by a market that was rigidly based on yearly rental payments.

There has never before been a choice with this much latitude. The market’s rising supply has kept pace with the short-let sector’s rising demand. In general, the short-let sector has shown to be a solid performer.

It went on to say that Nigerians living abroad have been a big contributor to the seasonality of short-let demand, which has caused occupancy levels to peak around significant holidays and record lower levels during off-peak seasons like between March and July.

The sheer volume of interest we have witnessed in the area over the past year indicates to a potential market saturation, according to EstateIntel’s Research and Insights Lead, Tilda Mwai. Notwithstanding our confidence in the prospects the short-let market presents, we would advise any new companies wanting to enter to take their time and make sure that their projects stand out or can still be competitive in an environment with a lot of supply.

Data suggest that Ikeja, Victoria Island, Lekki Phase 1, and Ikoyi are the top short-let hubs in Lagos, with Lekki Phase 1 standing out as a top performer by sustaining significantly higher occupancy levels at 80% compared to the 60% and 70% recorded in Ikoyi and Victoria Island.

2020’s COVID-19 epidemic reduced the demand for short-term rentals. In comparison to 2019, the World Tourism Organization (UNWTO) reports that the COVID-19 pandemic resulted in a 71% and a 72% decrease in visitor numbers in 2021 and 2020, respectively, a loss of 2.1 billion foreign arrivals in both years.

The market expansion would be aided by rising demand for international travel in developing economies and subsequent drops in flight rates worldwide, claims a Market View Research analysis.

To entice millennials and travelers seeking aesthetic outlets, major companies are also selling a variety of short-term rental accommodations, including private homes, villas, beach cottages, and apartments. The growth of the real estate sector is anticipated to be accelerated by this, promoting market expansion.

Furthermore, social media and the internet have increased consumers’ knowledge of services and products. In order to gain a larger market share, important companies provide exclusive services, exotic locations, and amenities, especially for female guests.

In essence, the short-let market is booming as a result of pricing competition. Lekki Phase I offers one-bedroom apartments for between N35, 000 and N45, 000 a day, with discounts offered for extended stays. A two-bedroom unit might cost between N50, 000 and N60, 000. On the mainland, the rate is the same, however it varies depending on where you are.