Real estate experts anticipate development and are optimistic

Experts projected a stronger year for real estate despite macroeconomic difficulties. It was not a good year for investments because of higher borrowing costs, rising interest rates, and inflation. Several property developers were compelled to consolidate their holdings, make investments in possibly more affordable assets, and realign their properties in order to adapt to changing consumer demand.

For example, the exchange rate more than doubled, placing pressure on importers of building materials and leading to high costs on the market. Building new homes and refurbishing existing ones both cost significantly more money.

The cost of financing real estate endeavors increased due to the rise in interest rates, which also resulted in lower investor returns. The solace for investors has been the sustained rent rise in apartments in key cities like Lagos, Abuja, Port Harcourt, Enugu, and Kano, as well as industrial assets tied to e-commerce where demand outstripped supply.

According to a recent National Bureau of Statistics (NBS) estimate, the GDP in the first three quarters of 2022 was N20 trillion, with the construction and real estate industries accounting for N20 trillion. Real estate made up N7tn of the GDP while construction services earned N12.9tn.

Other information from the research showed that in the third quarter of 2022, construction contributed 9.5% to nominal GDP. This was greater than the contribution it made in the same period last year (9.26%) and the second quarter of 2022 (7.95%).

The construction and real estate sectors contributed N20 trillion to the GDP in the first three quarters of 2022, according to a recent National Bureau of Statistics (NBS) study. Real estate contributed N7 trillion to the GDP, while construction services earned N12.9 trillion.

The research also stated that in the third quarter of 2022, construction contributed 9.5% to nominal GDP. This was greater than the 7.95% it contributed in the second quarter of 2022 and the 9.26% it contributed a year earlier.

In order to strengthen infrastructure and secure affordable housing, they ask for support from the business sector in anticipation of policy changes by the incoming administration.

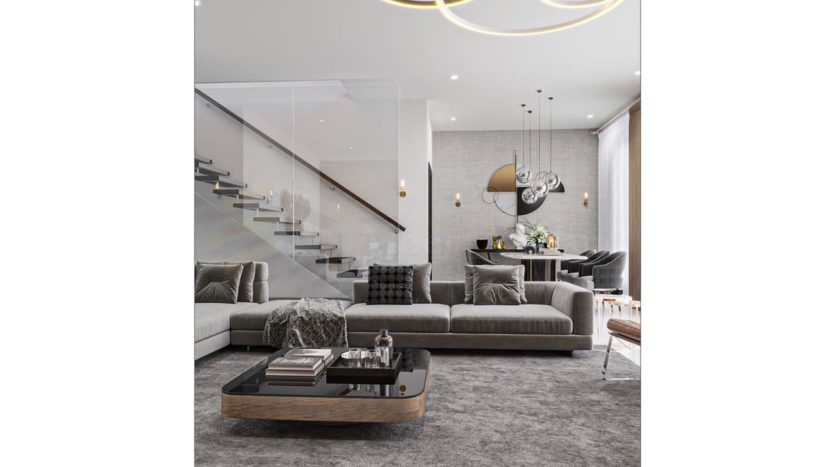

The chairman of the Association of Capital Market Valuers (ACMV), Mr. Chudi Ubosi, predicts that there will be a pent-up demand for residential properties, particularly those in the medium and low-income range, while the luxury market will continue to be desirable and serve as a store of value for investors. Investors would also be delighted by the student housing market, which is immature and developing slowly.

He predicted to The Guardian that the nation’s large population and about 20 million housing shortage will benefit real estate. “In terms of asset classes for investors, the Nigerian economy provides extremely few options. The demand for real estate investment will continue to be high due to a populace that is substantially aware of it. The demand for real estate will remain high as investors break out of their investing inertia and return to the real estate market, particularly after the election.

The capital market will be the next stop for real estate investors, according to Frank Okosun, Managing Partner and Chief Executive Officer of Knight Frank. “Real estate investors would be more tempted to invest in the capital market rather than holding their funds unutilised in light of the volatility in the equity market.

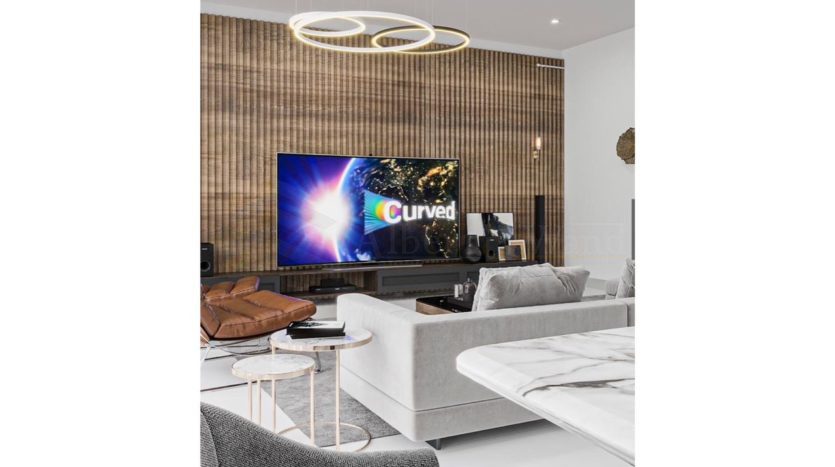

We anticipate that digital technology will have a bigger impact on how real estate products and services are delivered. Real estate developers’ increased interest in the provision of smart buildings, which can reduce operating costs, will be one way to see this.

Furthermore, as the proptech market continues to grow, real estate service operations will become more automated. Housing demand in urban areas will rise as a result of ongoing rural-to-urban migration. The rising inflationary pressure, which could reduce individuals’ spending power without a matching increase in income, will keep affordability a problem, though.

“There is a chance that the supply chain for imported building materials will be disrupted because COVID-19 is still a concern in nations like China and is also having an impact from the Russian-Ukrainian conflict. There is a strong likelihood that the affected imported building materials’ prices would rise consistently.

We anticipate that e-commerce (online sales) will continue to grow, thereby decreasing the need for retail space while, on the other hand, creating a chance to boost the availability of warehouse space.

Mr. Nathaniel Atebije, President of the Nigerian Institute of Town Planners (NITP), expressed hope that the industry will do better than the triumphs shown in earlier years.

By public sector commitment, the NITP President anticipates a real estate sector growth rate of over 5%. He claimed there is optimism for further improvement because of the tenacity the sector displayed last year.

The government’s monetary policy, particularly those that place limits on the amount of money that citizens will have access to, “could stymie that likelihood. The sector will be impacted by it. Investing may not be as high if cash flow is poor.

“Believing in the existence of a new government that will be receptive to the requirements of the populace. I read the manifestos of a few parties, and if they follow them, they have good ideas for the real estate industry.

“Some of the political leaders’ manifestos talk about providing housing; one of them specifically stated that their administration, if elected, would activate and implement everything about the urban and regional planning law, which is to say that they want an orderly development to be set,” he said.

Lack of planning and the improper placement of houses and infrastructure, according to Atebije, is one of the problems facing the real estate sector. But he said that it would be a good sign if the new administration implemented the entire planning law.

“I also think that the political class is more willing to change and more interested in the real estate sector as a result of the awareness-raising, sensitization, and lobbying efforts of professionals like NITP. We anticipate a predicted improvement in the economy’s cash flow as well as increased private sector investment in the real estate market. Yet at first, this might move slowly.

According to Prof. Yohana Izam, President of the Nigerian Institute of Building (NIOB), the real estate market would experience some growth as a result of population growth and the need to move forward with estate projects that were started in the second half of 2022.

As new administrations at the federal and state levels swiftly intervene in the housing market, he predicted that this expansion may approach 5%.

The vice chancellor of Plateau State University, Izam, stated: “There is, however, the concomitant risk of high pricing of construction inputs, notably material prices. The NIOB also anticipates that the National Building Code Enforcement statute will be completed prior to the election of the next administration.

Tasiu Sa’ad Gidari-Wudil, president of the Nigerian Society of Engineers (NSE), stated that engineers believe in continuous improvement and that the estate sector could perform better this year if private sector operators are encouraged by the provision of an enabling environment, especially financial incentives.

Clearly, we won’t settle for anything less than the prior year, and the industry must advance, he added. The government and developers have been urged to help the real estate industry. Our members are wholly committed to the construction sector, and ongoing construction activity is one of the criteria for development.

Gidari-Wudil emphasized the necessity for the government to encourage businesses in the private sector in order to act as a catalyst for growth and create accessible and long-lasting infrastructure.

“If you’re constructing an estate, you basically have to provide all the infrastructure. This implies that you are carrying out governmental duties. Housing, infrastructure, and roadways all have a deficit. Most new homes are not actually within the reach of the average person. We are pleading with the government to constantly invest in reasonably priced housing for the average person, especially for civil officials. More young people entering the sector is something we want the government to support.

“We are involved in all types of infrastructural projects and engage whoever emerged as president to ensure that the construction industry is given the necessary push,” the NSE president added.

The projected withdrawal of gasoline subsidies in June, in particular, according to Enyi Ben-Eboh, president of the Nigerian Institute of Architects (NIA), is one policy of the departing government that is likely to have an impact on the real estate market.

“In the immediate term, this directive’s effects will be felt by the increasing costs of almost all building materials, and it might take some time to fully comprehend those effects.

On the other hand, it implies that the government will receive more revenue, which, if well managed, can result in a steady improvement of the economy, which of course will have an impact on the real estate sector. It is unclear how quickly that might occur.

The stability of the exchange rate regime will be “another crucial factor, as this will minimize the current frequency of price fluctuation and outright uncertainty of the final cost of projects,” he said.

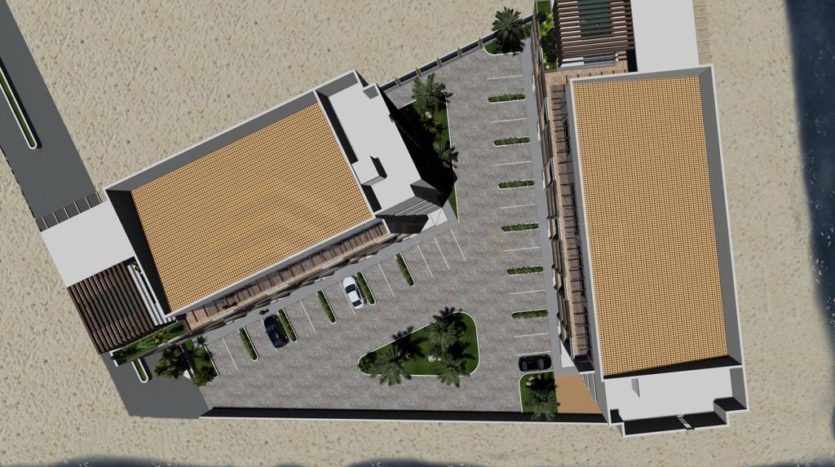

He claims that given the fact that there is a far greater demand than there is supply, the real estate industry is frequently driven by aspects like business viability, security, and the ability to pay for completed homes. Due to their commercial viability, close proximity to areas with high economic activity, and sense of improved security, it is anticipated that the major real estate hubs would continue to prosper. In 2023, there will be increased activity in the top five hubs of Lagos, Abuja, Rivers, Oyo, and Anambra, as well as Ogun and Enugu.

Ben-Eboh emphasized that the real estate sector is particularly susceptible to the state of the economy and that, in order for it to see a turnaround, the economy must first and foremost.

The president of NIA urged government to fortify partnerships with the private sector to advance policies and initiatives that will directly affect citizens, to create an environment that will encourage increased Foreign Direct Investment (FDI), which will in turn spur the growth of the real estate market, and to develop policies that are friendly to the local building material industry.