Exploring the Pros and Cons of Nigeria Ending Fuel Subsidies on Real Estate Investment

Nigeria, one of Africa’s largest economies, recently discontinued fuel subsidies, a policy shift with wide-ranging implications for various sectors. In this article, we will delve into the merits and demerits of Nigeria’s decision to end fuel subsidies and how it may impact the real estate investment landscape.

Pros

- Economic Stability and Fiscal Responsibility: By eliminating fuel subsidies, the Nigerian government aims to achieve economic stability and reduce budget deficits. This move can attract domestic and foreign investors to the real estate market, as it signals responsible governance and financial prudence.

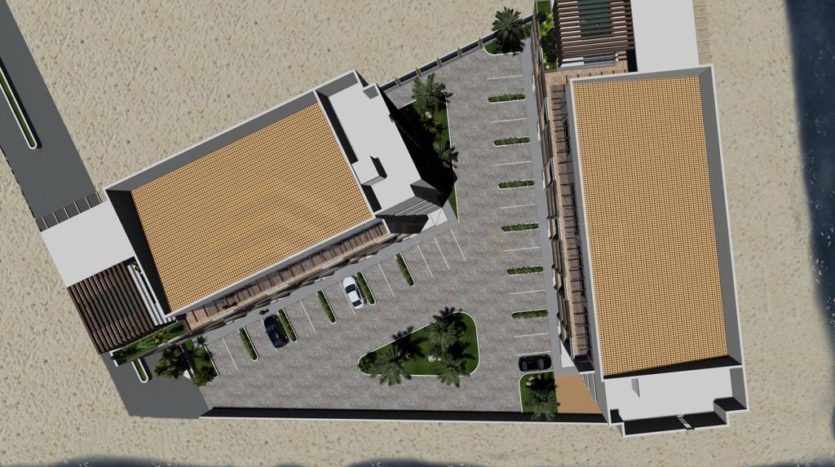

- Infrastructure Development: With the redirection of funds previously allocated to fuel subsidies, Nigeria can invest more in infrastructure development. Improved road networks, public transportation, and utilities will enhance the attractiveness of real estate investments, particularly in well-connected areas, leading to increased property values.

- Sustainable Investment Opportunities: The discontinuation of fuel subsidies aligns with global efforts to transition to sustainable and greener energy sources. Real estate investors can explore environmentally-friendly projects, such as energy-efficient buildings, renewable energy installations, and sustainable communities. These investments not only contribute to a greener future but also appeal to eco-conscious buyers and tenants.

Cons:

- Increased Transportation Costs: The removal of fuel subsidies may result in higher transportation costs, which can indirectly impact the rental market. Landlords may need to consider these increased expenses when determining rental prices. This change could potentially affect affordability for tenants and necessitate the reassessment of rental pricing strategies.

- Market Volatility and Uncertainty: The discontinuation of fuel subsidies introduces an element of market volatility and uncertainty. Fluctuations in transportation costs, potential inflationary pressures, or socio-political ramifications can impact the real estate investment landscape. Investors must carefully assess these risks and adapt their strategies accordingly.

- Potential Inflationary Pressures: Fuel subsidies have historically contributed to inflationary pressures. While their removal aims to stabilize the economy, it is essential to monitor the potential impact on overall inflation rates. Higher inflation could lead to increased construction costs, affecting real estate development and investment profitability.

Conclusion

The discontinuation of fuel subsidies in Nigeria carries both merits and demerits for real estate investment. It offers opportunities for economic stability, infrastructure development, and sustainable investments. However, challenges such as increased transportation costs, market volatility, and potential inflationary pressures must be considered. As real estate investors navigate this evolving landscape, thorough research, risk assessment, and adaptation to changing market conditions remain crucial for successful investments.